What I Learned Driving Across the American South: 7 Key Lessons

Dec 09, 2024

The Netherlands Travel Guide

Nov 03, 2023

Costa Rica's Most Famous Volcano Arenal: The Complete Guide

Dec 02, 2023

How To Make an IRA Contribution as a Gift

Oct 28, 2024 By Kelly Walker

Have you wondered how to make a meaningful contribution as a gift that will have lasting effects? Look no further than making an IRA contribution!

An individual retirement account (IRA) is the perfect way to start saving for your future, and giving one as a gift can help set up your loved ones for financial success.

Here, we’ll discuss why gifting an IRA is beneficial, who can contribute, the different types of IRAs available, and the steps to make an IRA contribution. Read on if you want to give the best possible present with long-term benefits this holiday season!

What is an IRA Contribution, and Why Make It a Gift

An IRA contribution is an individual retirement account that allows you to save money for your future. When contributing to an IRA, the money in the account is tax-deferred, meaning it can grow over time without being subject to taxes until you begin making withdrawals.

Making an IRA contribution as a gift has several benefits.It can supplement existing retirement savings, provide tax benefits for both the giver and receiver, and is a thoughtful present with lasting effects.

Who Can Make an IRA Contribution as a Gift

An IRA contribution as a gift is an excellent way to show your support for a loved one's future financial success. Anyone can contribute IRA, including the intended beneficiary's spouses, parents, and grandparents.

However, it is important to note that if you are gifting an IRA contribution to someone other than your spouse, the Internal Revenue Service (IR) requires they are at least 18. Additionally, only individuals with earned income can make an IRA contribution. In other words, the giftee must earn wages, salary, or self-employment to establish and contribute to an IRA account.

It is also important to understand that IRA accounts have annual contribution limits. For 2020, the maximum contribution limit is $6,000 or 100% of earned income, whichever is less. If you’re gifting an IRA contribution to someone over 50, they can make a catch-up contribution of an additional $1,000.

Types of IRAs that can be Gifted

When gifting an IRA, there are several types to choose from. Traditional and Roth IRAs are the two most popular choices, but other options exist.

Traditional IRA

A traditional IRA allows contributions to be made pre-tax, with tax-deferred growth. Contributions may be tax deductible depending on income and filing status, while withdrawals are taxed at the recipient’s ordinary income rate in retirement.

Roth IRA

A Roth IRA is a post-tax contribution plan, meaning that contributions are made with after-tax money, but the growth is tax-free. Withdrawals are also tax-free in retirement.

SEP IRA

A Simplified Employee Pension (SEP) IRA is available for small business owners or self-employed individuals. It allows the recipient to make larger contributions than other types of IRAs, up to $57,000 annually. Contributions are made pre-tax, and withdrawals are taxed at the recipient’s ordinary income tax rate.

SIMPLE IRA

Savings Incentive, Match Plans for Employees (SIMPLE) IRAs are available to employers with fewer than 100 employees. They allow employer and employee contributions up to a maximum of $13,500 annually. Contributions are made pre-tax, and withdrawals are taxed at the recipient’s ordinary income tax rate.

Other Types of IRAs

Other types of IRAs include spousal IRAs, Health Savings Accounts (HSAs), 401(k)s, and 403(b)s. Each one offers unique benefits and restrictions, so make sure to do your research before making a decision.

How to Make an IRA Contribution as a Gift

The first step to making an IRA contribution as a gift is determining who is eligible to contribute. Generally, anyone under 70½ with taxable compensation can contribute to an IRA; however, those over 50 can make catch-up contributions to certain IRAs. It’s important to remember that the recipient must be eligible for the type of IRA you are contributing to.

The next step is to decide which type of IRA you want to contribute to; there are three main types: Traditional, Roth, and SEP IRAs. Traditional IRAs are funded with pre-tax money, while Roth IRAs are funded with after-tax contributions that may qualify for tax-free withdrawals in retirement.

SEP IRAs are employer-sponsored plans that allow employers to make tax-deductible contributions towards the employee’s retirement.

Finally, you can set up the IRA contribution with an online broker, financial advisor, or even through your bank. Most custodians have step-by-step instructions for setting up a new account, and you will need to provide some basic information such as the recipient’s name, address, Social Security Number, and bank account info.

Once the account is set up, you can make regular contributions or a one-time payment.

Tips for Making the Process Smooth and Successful

- Make sure you choose the right type of IRA for your recipient. Some types may have different eligibility criteria or require different levels of contributions.

- Check the contribution limits for each type of IRA and ensure you stay within them.

- Have the plan to explain how the recipient can use their IRA funds and any other related financial topics they may need to understand.

- Consider setting up automatic deposits from your bank account to the recipient's IRA account so they can easily manage their contributions.

- When making an IRA contribution as a gift, it’s important to stay organized and keep track of all transactions. Ensure you have records of every transfer and deposit made into the recipient's account.

Understanding the Tax Implications of Gifting an IRA Contribution

Gifting an IRA contribution can be a great way to help your loved ones start saving for their retirement. However, it’s important to understand the tax implications of a gift before making any decisions.

When gifting an IRA contribution as a gift, you are exempt from paying gift taxes if the amount is less than $15,000. However, the gift recipient must be mindful of the amount they can contribute to their IRA in one year.

For 2020, individuals aged 50 and older can make an additional catch-up contribution of up to $6,500 for $7,000. Individuals under 50 can contribute up to $6,000 in one year.

The gift recipient should also be aware that contributions to IRAs are tax-deferred, meaning that the money will only be taxed once it is withdrawn at retirement age. If the funds are withdrawn prematurely, additional taxes and penalties may be associated with this decision.

It is also important to consider the tax implications of your contributions when gifting an IRA contribution. If you are making a gift as part of your retirement planning, be aware that the amount contributed is not deductible from your taxes if it exceeds $6,000 per year (or $7,000 for those age 50 and older).

FAQs

Can I gift an IRA contribution?

Yes! An IRA is a great way to give the gift of financial security. You can contribute annually to someone else’s IRA, which will be a meaningful gesture with lasting effects.

Who can contribute to an IRA?

Anyone with earned income can open and contribute to an individual retirement account. However, the amount you can contribute yearly depends on your age and income level.

Can I gift my IRA without paying taxes?

Yes, as long as you are within the contribution limits, your gift will not be subject to taxes.

Conclusion

Making an IRA contribution as a gift is an excellent way to benefit the recipient of your generosity and reduce your taxable income. It's important to understand the differences between traditional and Roth IRA contributions, figure out what type of account you'd like to gift, and keep track of all documents associated with the transaction.

Furthermore, it’s essential to consider the tax implications when gifting an IRA contribution to maximize the potential benefit both you and the recipient may gain.

What Things to Do in Thailand to Spend Quality Time?

Feb 07, 2024

Learn how to best use your time on your trip. Here are all the best things to do in Thailand for the most authentic experience.

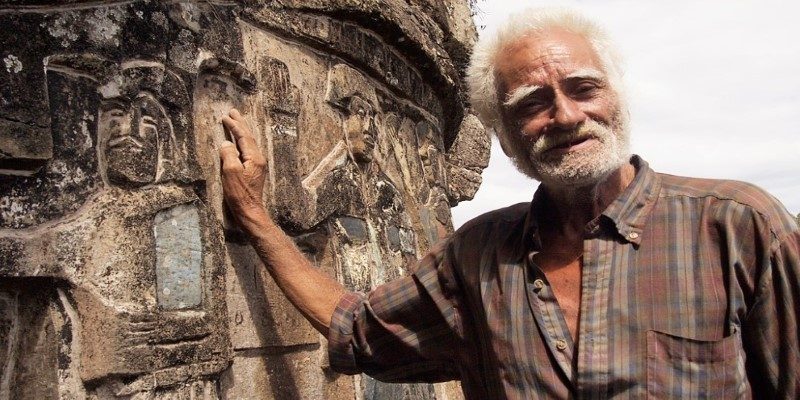

Unveiling the Stone Carving Hermit: Nicaragua’s Artistic and Spiritual Retreat

Dec 12, 2024

Visit the Stone Carving Hermit of Nicaragua and discover a unique artistic expression that blends history, spirituality, and craftsmanship. Learn about this hidden gem of Nicaraguan culture

Top 5 places to visit in kashmir

Oct 28, 2023

Looking to visit historical places in Jammu and Kashmir? We have a list of the best tourist places in Kashmir. Stay tuned.

Wheelchair-Friendly Journeys: A Guide to Traveling the World with Ease

Dec 09, 2024

How to travel the world in a wheelchair with these practical tips, from accessible transport to finding the best destinations and accommodations. Enjoy your journey without limits

Which Are The 5 Best Local Living Tours In Ranikhet: An Overview

Nov 15, 2023

Enjoy nature, culture, and excitement on these trips you'll never forget. These tours will help you discover the magical beauty of Ranikhet

How To Make an IRA Contribution as a Gift

Oct 28, 2024

Give the gift of retirement security with an IRA contribution. Learn more about how to make this valuable and lasting contribution to your loved ones.

10 The Best Places To Visit In Jalgaon In 2023: An Overview

Oct 22, 2023

Omkareshwar Mandir, Patna Devi, Shree Manudevi, Waghur Dam, Shree Sant Muktabai Temple, Padmalaya, and Mahatma Gandhi Garden are the best places to visit in Jalgaon in 2023

10 Must-Try Tapas Dishes in Spain

Nov 08, 2024

From classic favorites like patatas bravas and jamón ibérico to regional specialties such as pulpo a la gallega, these bite-sized dishes offer a true taste of Spanish culture. Whether you're visiting Madrid, Seville, or Barcelona, this list will help you navigate Spain’s rich culinary traditions and enjoy some of the most delicious tapas the country has to offer.

8 Ways to Stay Safe While Traveling Alone As A Woman

Dec 05, 2023

Traveling alone as a woman can be an empowering and exciting experience. However, it’s important to remember safety measures to ensure a safe and enjoyable trip. This includes being aware of your belongings at all times, avoiding trusting too readily wit strangers, and avoiding dimly lit or isolated areas.